Going into international markets opens up fascinating new possibilities, but it also makes following the rules more difficult. When businesses send things across borders, they have to respect the laws, taxes, and customs restrictions of the country they’re sending them to. That’s when things like Importer of Record (IOR), Exporter of Record (EOR), and Delivered Duty Paid (DDP) come in.

Companies can prevent delays, fines, and extra costs by knowing what IOR, EOR, and DDP mean. Let’s look at them one by one and discover which one is best for your worldwide trading needs.

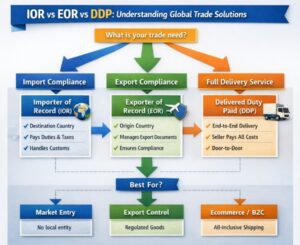

What does it mean to be an Importer of Record (IOR)?

The Importer of Record (IOR) is the company that is legally responsible for making sure that imported goods follow the laws and rules of the country they are going to.

IOR’s main duties are:

- Customs forms and paperwork

- Paying taxes and tariffs on imports

- Product compliance (certifications, labels, and standards)

- How to deal with customs inspections or audits

When to Use IOR:

- If you don’t have a business in the country you’re going to

- For electronics, medical gadgets, or other things that are not allowed

- For B2B shipments that need to follow the rules strictly

Best for: Businesses who want to access new markets without having to set up a local firm.

What is an EOR, or Exporter of Record?

An Exporter of Record (EOR) is the company that is legally in charge of sending products out of the nation of origin.

EOR’s main duties are:

- Documents for export

- Licensing for exports

- Compliance and screening for trade

- Declaring value and classifying products

When to Use EOR:

- When sending goods out of nations with severe export rules

- When sending materials that are sensitive or controlled

- When manufacturers don’t want to be responsible for legal exports

Best for: Businesses who need legal protection when they export goods.

What does “Delivered Duty Paid” (DDP) mean?

DDP (Delivered Duty Paid) is an Incoterm that means the seller is fully responsible for transporting products to the buyer’s location. This includes:

- Shipping costs

- Clearance through customs

- Taxes and tariffs on imports

- Risk till the last delivery

The customer gets the products without having to deal with customs.

When to Use DDP:

- For shipping to businesses or consumers

- When you wish to give prices that cover everything

- To make the customer experience better

Best for: sellers that want to be in charge of delivery and know how much it will cost.

IOR, EOR, and DDP: What Sets Them Apart

📦 Importer of Record (IOR)

Role: Role of compliance in imports

Covers: The country of destination

Responsibility under the law: The import side

Best for: Entering a new market

Customs handled by: IOR

🚢 Exporter of Record (EOR)

Role: Compliance for exports

Covers: Country of origin

Responsibility under the law: The seller on the export side

Best for: Controlling exports

Customs handled by: EOR

🏠 Delivered Duty Paid (DDP)

Role: Responsibility for delivery

Covers: Delivery from start to finish

Responsibility under the law: Takes on all the risk

Best for: Ecommerce and B2C

Customs handled by: Seller / IOR provider

Which One Should You Choose?

Your choice relies on the direction of your firm and the way you do business:

Pick IOR if:

✔ You don’t have a business in the country where you import goods

✔ You transport regulated or high-value goods

✔ You wish to avoid compliance risk

Pick EOR if:

✔ You export from places that are regulated

✔ You don’t have an export license

✔ You wish to change who is legally responsible

If you want to use DDP:

✔ You sell directly to customers

✔ You want to make it easier for buyers

✔ You want to know how much it will cost to land

Can I put these solutions together?

Yes. A lot of firms put them together:

- IOR + DDP: The seller takes care of delivery and making sure the goods are imported correctly.

- EOR and IOR: Both sides are fully lawful.

- DDP with an IOR partner: The seller offers DDP without having an organization.

This mixed methodology is common in shipping of IT and ecommerce goods around the world.

Why These Solutions Are Important for Global Trade

Companies who don’t have the right IOR, EOR, or DDP structure risk:

❌ Customs delays

❌ Shipments getting seized

❌ Fines and penalties

❌ Damaged customer trust

With the proper solution, you get:

✅ Faster customs clearance

✅ Less legal risk

✅ Clear costs

✅ The flexibility to grow globally

Last Thoughts

There isn’t one answer that works for everyone.

IOR, EOR, and DDP all have various uses, and the appropriate one for you relies on:

- The direction of your shipment

- Your legal presence

- How much danger you’re willing to take

- Your model of a customer

Picking the proper compliance approach is just as crucial as picking the right freight partner if you want international trade to go smoothly.