A commercial invoice is one of the most important paperwork for shipping items over the world. It tells customs officers about the items being shipped, their worth, and the people who are sending them. If you make a clear and accurate commercial invoice, you won’t have to worry about delays, fines, or having your shipment turned away at customs. This is how to write a commercial invoice that will make it easy for customs to let you through.

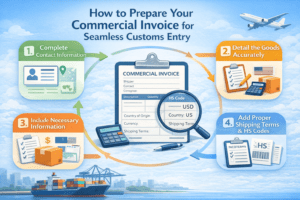

1. Write down everything you know about the buyer and seller

A correct commercial invoice must clearly show:

- Seller’s (exporter’s) name, address, phone number, and tax ID

- Buyer’s (importer’s) name, address, and phone number

When you have the right information, things are less confusing and customs clearance goes faster.

2. Describe the goods correctly

Provide a comprehensive description of each item, such as:

- Product name and model

- Material or composition

- Quantity and unit of measure

- Size and weight

If you offer customs authorities detailed descriptions of your goods, they won’t misclassify them. This could lead to delays or increased costs.

3. Use the Right HS Codes

The Harmonized System (HS) code organizes goods for international trade. It’s vital to use the correct HS code because it determines:

- Customs duties

- Import/export restrictions

- Regulatory compliance

Using the wrong HS codes can result in fees or your package being turned away.

4. Give the right values and money

For each item, write down the unit price, total value, and currency. Add extra fees like:

- Shipping costs

- Insurance

- Handling fees

A correct valuation ensures proper customs duties and eliminates problems with customs officials.

5. State the Terms of Sale (Incoterms)

Clearly list the Incoterms (e.g., FOB, CIF, DDP) on the commercial invoice. This tells customs and the customer who is responsible for:

- Shipping costs

- Insurance

- Customs duties

Using the correct Incoterms makes things clearer and speeds up customs clearance.

6. Add more information

Include the following depending on the shipment:

- Country of origin

- Invoice number and date

- Signatures of the exporter

- Any special handling instructions

More information makes customs processing faster and easier.

7. Keep Copies for Your Records

Always maintain copies of your commercial invoices for:

- Customs audits

- Internal accounting

- Insurance claims

Proper record-keeping protects your business in case of disputes.

Last Thoughts

A properly filled out commercial invoice is necessary for smooth customs entry. You may cut down on delays, fines, and shipping issues by ensuring seller and buyer information is correct, product descriptions are clear, HS codes are accurate, and values are correct.

MAF IOR solutions makes it easy for you to ship internationally. Their expertise helps you prepare commercial invoices, handle customs clearance, and ensure your products get to their destination safely and on time.